In the first nine months of 2025, the Brand Group Core continued its positive development and significantly improved vehicle sales, sales revenue and the operating result. The main drivers of this positive development were cost reductions resulting from the performance programs of the brands, as a result of which the operating result of the brand group grew 6.8% to 4.7 billion euros (+6.8%). Successful model launches and strong demand for models such as the Tayron, T-Cross und ID.7 Tourer, as well as the new Volkswagen Transporter/Multivan, CUPRA Terramar and Škoda Elroq also contributed to this success. However, the ramp-up of the lower-margin electric vehicles as well as expenses for US import duties had a significant negative influence on the cumulative result. Restructuring measures, especially for the Volkswagen brand, had further negative impact on the result and net cash flow.

“Even in the traditionally challenging third quarter, when the plant vacation season has a pronounced effect, the strength of the Brand Group Core has been evident. In the first nine months of the year, we significantly improved vehicle sales, sales revenue and the operating result.

Our active work on costs is gaining traction.

However, at the same time, special items are having a significant adverse impact on our result. On a positive note, we are successfully launching new models in the marketplace faster than before. This will be the crucial lever for safeguarding our competitiveness as a brand group in the global environment.”

David Powels, Member of the Board of Management of the Volkswagen Brand

responsible for Finance and responsible for Finance at the Brand Group Core

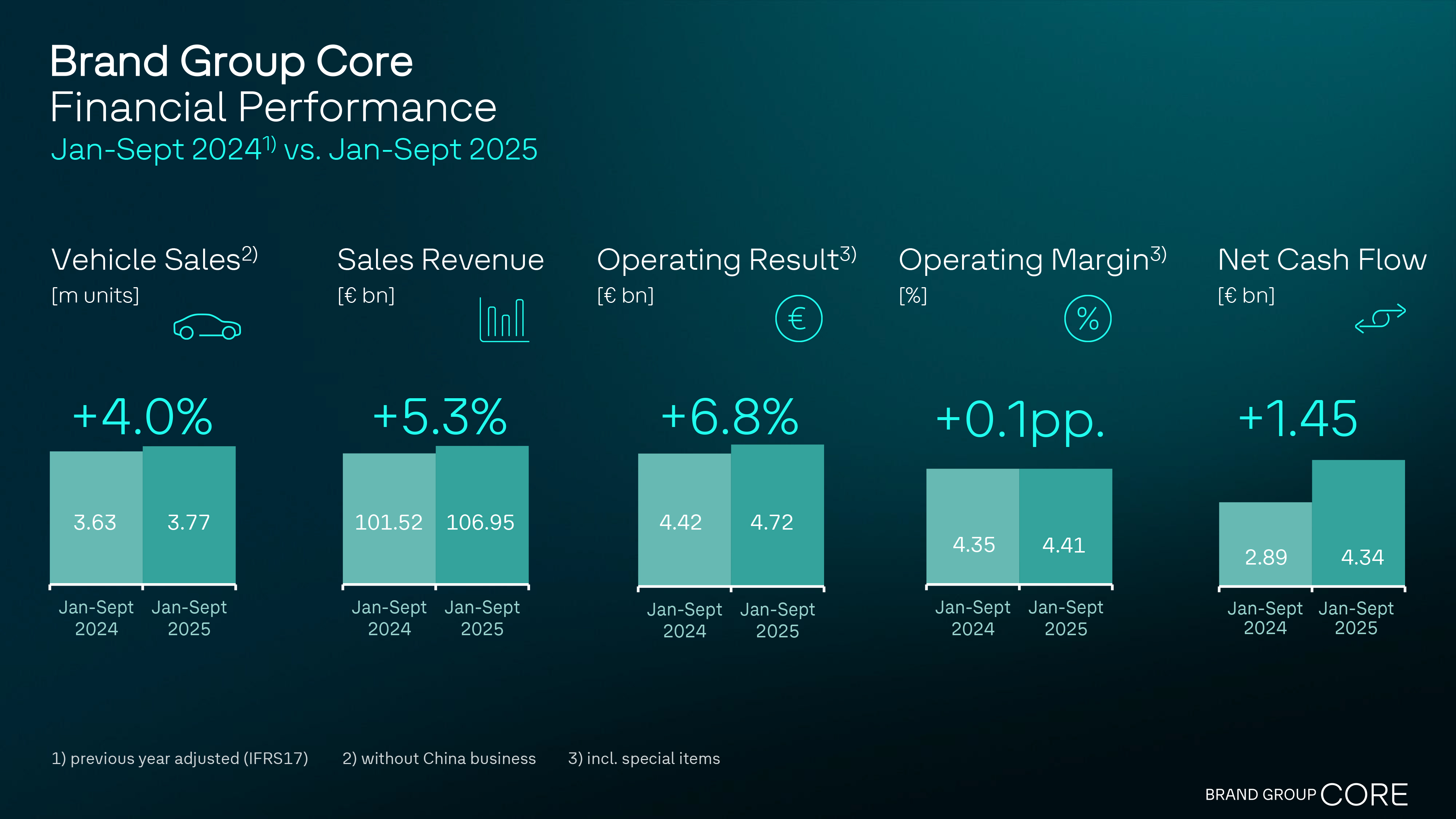

| Unit sales grew to 3.77 million vehicles (without China) (Q1 – Q3 2024: 3.63 million vehicles) |

Compared with the previous year, unit sales grew by 4.0%. Growth was driven especially by new models with all types of powertrain. In overall terms, the core brands were able to win market shares. |

|

| Sales revenue grew significantly to 106.95 billion euros (Q1 – Q3 2024: 101.52 billion euros) |

In a highly competitive environment, the sales revenue of the Brand Group Core grew significantly by 5.3%, buoyed by higher unit sales. | |

| Operating result of 4.72 billion euros (Q1 – Q3 2024: 4.42 billion euros) |

Despite significant additional expenses for US import duties and the ramp-up of lower-margin electric vehicles, the operating result was boosted by 6.8% compared with the same prior-year period. Higher unit sales and cost reductions as a result of the salary effects of the “Zukunft Volkswagen” program had a positive impact. | |

| Operating margin of 4.41% (Q1 – Q3 2024: 4.35%) |

Despite additional adverse impacts, the operating margin remained stable at the prior-year level. Without the adverse impacts mentioned, the operating margin of the Brand Group would be 5.5% and that of the Volkswagen brand would be 4.0%. | |

| Net cash flow significantly improved to 4.34 billion euros ( Q1 – Q3 2024: 2.89 billion euros) |

Compared with the previous year, net cash flow improved by 1.45 billion euros as a result of inventory reductions, disciplined investment policies and reduced development expenses. | |

Review: Q3 / Jan-Sept 2025

In the third quarter of 2025, the Brand Group Core continued its positive development in terms of vehicle sales, sales revenue and operating result and benefited from the broad-based cross-brand product offensive.

The successful launch of the Volkswagen Tayron as well as strong demand for the

T-Cross and new models such as the ID.7 Tourer, Transporter/Multivan, CUPRA Terramar and Škoda Elroq resulted in high levels of incoming orders.

Thanks to more intensive cooperation within the development network, it was possible to reduce costs and improve the operating result. Shared technologies and standards allow synergy effects across all the brands. The performance programs of the Brand Group Core brands bore fruit in terms of fixed costs, which were reduced significantly both in percentage and absolute terms compared with the same prior-year period.

The first nine months of the year were impacted by negative exchange rate effects and a changed model mix with a higher BEV share.

US import duties and restructuring measures with a total amount of about 1.1 billion euros also had significant adverse impact. Without these effects, the cumulative operating margin of the Brand Group Core would have been 5.5% and that of the Volkswagen brand would have been 4.0%

Outlook

Within the Brand Group Core, the focus is on the consistent implementation of cost reductions from the brands’ performance programs.

The Volkswagen brand is working consistently on the implementation of the “BOOST 2030” corporate strategy with a view to becoming the world’s technologically leading volume manufacturer by 2030.

The key levers are the continuous improvement of efficiency, more intensive cross-brand cooperation and leveraging synergy potentials within the global production and development network.

The production network within the brand group is controlled via five regions in order to effectively utilize regional strengths and to align production even more efficiently.

At the same time, Technical Development is also being reorganized across the brands with a view to significantly reducing development times and reacting faster to the needs of customers and the marketplace.

With the launch of the cross-brand Electric Urban Car Family from 2026 under the project management of SEAT/CUPRA , the Brand Group Core will be setting a further milestone on the way to affordable, sustainable e-mobility.

The four planned models – two from the Volkswagen brand and one each from CUPRA and Škoda – will be built at the Spanish plants in Martorell and Pamplona. The “Electric Urban Car Family” project will unlock synergy potential of more than 600 million euros across the entire product life cycle.

Overview of the brands in the Brand Group Core

|

Volkswagen Passenger Cars The operating result rose to 1.48 billion euros (previous year: 1.28 billion euros) while the operating return increased to 2.3% (previous year: 2.0%).Cost reductions from the “Zukunft Volkswagen” program had a positive effect while the operating result was negatively impacted by special items arising from the US import tariffs, restructuring costs and the ramp up of lower-margin electric vehicles.Without these special items, the operating margin of the Volkswagen brand after nine months would have been 4.0%. |

|

|

|

“We see a strong dynamic for our models, especially the Tayron, T-Cross and ID. family. Nevertheless, we continue to operate in a volatile global environment: the challenges in China and the strong headwind from the USA as a result of import tariffs are impacting profitability and cash flow. David Powels, Member of the Board of Management of the Volkswagen Brand, |

|

Škoda Auto The operating result improved by 5.4% to 1.79 billion euros, resulting in a solid operating revenue of 8.0%. In addition, Škoda successfully continued its electrification strategy in Europe. The share of electric vehicles (BEV and PHEV) in the portfolio rose from 11.1% in the comparable prior year period to 24.1%. This development was especially due to the Elroq with orders since the beginning of sales already reaching 100,000. The internationalization strategy of the brand is also gaining traction, especially in India, where a delivery record of 49,400 vehicles (+106.1%) was reached. |

|

|

|

“The results of the third quarter bear witness to the strength of our business model. Despite continuing challenges in the market environment, we were able to grow both sales revenue and our operating result thanks to continuing strong demand for our models. At the same time, we reached a robust operating margin of 8%. This confirms that our “Level Efficiency +” program is bearing fruit, while we grow profitably thanks to consistent cost control and synergies within the Brand Group Core. Holger Peters |

|

SEAT/CUPRA |

|

|

|

“We expected an exceptionally challenging environment calling for flexibility and agility in order to meet our targets. In the coming months we will continue to concentrate on the margin quality of our electric vehicles, while at the same time driving our cost control programs forward. We will continue to work on positioning SEAT S.A. as an even more sustainable and profitable company by concentrating on our strategic priorities.” Patrik Andreas Mayer, |

|

Volkswagen Commercial Vehicles |

|

|

|

“The delivery figures and the higher sales revenue compared with the previous year are positive developments for us. Our vehicles are very well received by commercial and leisure customers. The intensified competitive environment and especially provisions in connection with fleet CO₂ regulations in Europe had a significant negative impact on our operating result.” Michael Obrowski |

Key figures for the Brand Group Core:

|

Key financials |

Jan-Sept 2025 |

Jan-Sept 2024 |

Change 25 /24 |

|

Unit sales |

3.771 |

3.627 |

+4.0% |

|

Sales revenue |

106.950 billion € |

101.523 billion € |

+5.3% |

|

Operating result |

4.719 billion € |

4.419 billion € |

+6.8% |

|

Operating margin |

4.41% |

4.35% |

+0.1% points |

|

Net cash flow |

4.340 billion € |

2.894 billion € |

+1.446 billion € |

Key figures for the brands belonging to the Brand Group Core:

|

|

Unit sales |

Sales revenue |

Operating result |

Operating margin |

||||

|

Units/Mill. € |

Jan-Sept |

Jan-Sept |

Jan-Sept |

Jan-Sept |

Jan-Sept |

Jan-Sept |

Jan-Sept |

Jan-Sept |

|

Volkswagen Passenger Cars |

2,279,197* |

2,260,151* |

63,811 |

63,535 |

1,476 |

1,281 |

2.3% |

2.0% |

|

Škoda Auto |

869,653* |

808,647* |

22,342 |

20,399 |

1,790 |

1,699 |

8.0% |

8.3% |

|

SEAT/CUPRA |

480,627* |

466,374* |

11,241 |

10,515 |

16 |

415 |

0.1% |

3.9% |

|

Volkswagen |

323,900 |

309,837 |

12,539 |

11,093 |

220 |

599 |

1.8% |

5.4% |

*) Also includes sales to sales companies including other Group brands