“Despite stable vehicle sales, in part bolstered by the launch of attractive new models such as the Tiguan, Golf and the all- electric ID.7 Tourer, we were not able to offset higher fixed costs in the third quarter, especially at the VW brand.

Moreover, the market headwinds have become even stronger in recent months. That is why we need more far-reaching measures to finance necessary investments and thus safeguard the future of Volkswagen for the long term. In order to increase our profitability, we must vigorously expand and execute our performance programmes. We have strong products, from ICEs and hybrids through to all-electric models. Provided we keep our eyes on the ball as regards costs, this is an excellent foundation for a good future.”

David Powels, new Member of the Board of Management of the Volkswagen Brand responsible for Finance since October 1, 2024, and responsible for Finance at the Brand Group Core

Key figures (Jan. – Sept. 2024)

|

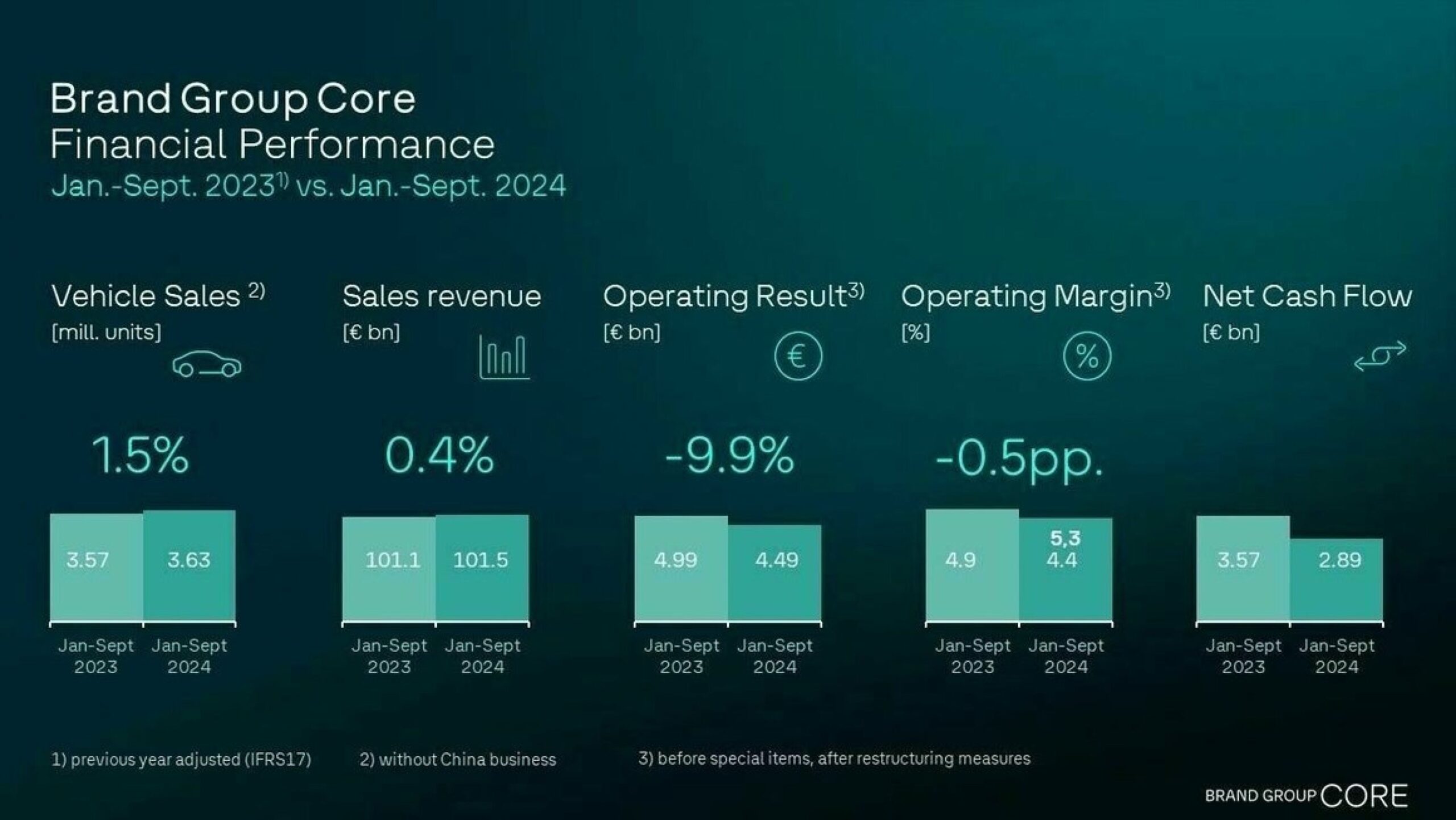

Unit sales of 3.63 million vehicles in the first nine months |

Slight growth of 1.5% in unit sales in the first nine months of the year compared with the same prior-year period (Q3 2023: +0.7%). |

|

Brand Group Core sales revenue of 101.5 billion euros in year to date at a stable level |

Stable sales volumes in a challenging competitive environment due to slightly higher unit sales and pricing measures. |

|

Operating result came in at 4.49 billion euros (2023: 4.99 billion euros). |

Higher fixed costs and expenses for restructuring measures impacted the operating result and could not be offset by volume growth. |

|

Brand Group Core operating margin of 4.4% in the first three quarters of the year |

Adjusted for provisions for termination agreements, the Brand Group Core’s operating return on sales in the first three quarters came in at 5.2%, but was only 3.2% in Q3 2024. |

|

Net cash flow of 2.89 billion euros was 19.0% lower than the comparable prior-year period. |

Higher inventories as a result of the model offensive and a rise in receivables led to a decrease in net cash flow. |

Outlook

In a year shaped by a persistently weak economic environment, more intense competition and political challenges, the Brand Group Core continues to concentrate in 2024 on successful model ramp-ups and execution of the performance programmes in the various brands. With a clear focus on strict cost efficiency and the realisation of synergies generated by cooperation, the Brand Group is currently developing more far- reaching measures to secure necessary investments for the future – and to increase profitability in the coming quarters. The basic principle is: Costs and expenditure down, efficiency, productivity and competitiveness up. The brands’ performance programmes are closely tailored to these goals. The ambition is to further extend quality leadership, innovativeness and product substance for the long term.

There is a trend for higher demand for the Polo and the ID. 7. The volume brands reached important milestones in the first nine months of the year with the launch of attractive model innovations such as the Volkswagen Tiguan, Golf, ID.7 Tourer and VW Transporter, Škoda Octavia and Elroq as well as the CUPRA Terramar and Tavascan. The Brand Group Core therefore anticipates significantly more positive momentum in the coming months, as the market presence of the new models intensifies.

Overview of the brands in the Brand Group Core

|

Volkswagen Passenger Cars |

Škoda Auto |

|

SEAT/CUPRA |

Volkswagen Commercial Vehicles |

Key figures for the Brand Group Core:

|

Key financials |

|

Jan. – Sept. 2024 |

|

Jan. – Sept. 2023 |

|

Change 24 /23 |

|

Unit sales (thousand units; incl. vehicles from other brands) |

|

3,627 |

|

3,575 |

|

1.5% |

|

Sales revenue |

|

101,523 million € |

|

101,060 million € |

|

0.4% |

|

Operating result before special items, after restructuring |

|

4,491 million € |

|

4,985 million € |

|

-9.9% |

|

Operating margin before special items, after restructuring |

|

4.4% |

|

4.9% |

|

-0.5%-points |

|

Net cash flow |

|

2,894 million € |

|

3,573 million € |

|

-19.0% |

Key figures for the brands belonging to the Brand Group Core1):

|

Unit sales |

Sales revenue |

Operating result |

Operating return |

|||||||||||||

|

000 units/ mill € |

|

Jan.- Sept. 24 |

|

Jan.- Sept. 23 |

|

Jan.- Sept. 24 |

|

Jan.- Sept. 23 |

|

Jan.- Sept. 24 |

|

Jan.- Sept. 23 |

|

Jan.- Sept. 24 |

|

Jan.- Sept. 23 |

|

Volkswagen |

|

2,260 |

|

2,238 |

|

63,535 |

|

63,390 |

|

1,341 |

|

2,126 |

|

2.1% |

|

3.4% |

|

Škoda Auto |

|

809 |

|

778 |

|

20,399 |

|

19,659 |

|

1,699 |

|

1,260 |

|

8.3% |

|

6.4% |

|

SEAT/CUPRA |

|

466 |

|

454 |

|

10,515 |

|

10,837 |

|

415 |

|

501 |

|

3.9% |

|

4.6% |

|

Volkswagen Commercial |

|

310 |

|

313 |

|

11,093 |

|

11,109 |

|

606 |

|

672 |

|

5.5% |

|

6.0% |

1) before special items, after restructuring measures